Google Stock Price Prediction 2023 – 2030, Future of Google Stock, Google Stock Forecast 2030, Google Stock Analysis

Google (GOOGL) stands out as one of the globe’s leading technology giants, boasting a vast and varied portfolio comprising more than 400 companies, startups, and digital platforms. The pivotal moment came in 2015 when Google transformed into a subsidiary of Alphabet Inc., a corporate entity organized into two primary divisions,

- Google LLC: As one of its prominent divisions, Google LLC is responsible for overseeing a wide array of essential services. This includes the renowned Google search engine, the popular Android operating system, the video-sharing platform YouTube, the cutting-edge Google Cloud services, and the effective Google Ads platform.

- Other Bets: Another integral part of Alphabet Inc. is the ”Other Bets” group. This segment houses innovative startups that may not be immediately profitable but exhibit promising potential for the future. Alphabet provides financial support to these ventures, fostering their growth and development, such as the pioneering work in the self-driving automobile domain.

Google and Alphabet play an integral role in driving advancements across various sectors, including cloud technologies, information storage, machine learning, and artificial intelligence. Their consistent focus on innovation has contributed to a steady upward trend in their price chart over the long term. However, it’s important to note that occasional declines have been observed during periods of global economic slowdowns, as seen in 2008 and 2020. These short-term fluctuations can be attributed to speculative capital shifting from stocks to currency during times of global economic instability. Despite these temporary dips, the overall trajectory remains positive, underlining the companies’ resilience and potential for growth in the technology sector. As with any investment, prudent decision-making requires comprehensive research, understanding of your investment goals, and consultation with a financial advisor.

Disclaimer

The content of this article is not intended as investment advice or a recommendation to purchase stocks. The projected GOOGL stock price is based on independent evaluations made at the present moment. However, it’s essential to acknowledge that circumstances can change over time, and the actual stock price may vary from the forecasted values. It is crucial to recognize that stocks inherently carry volatility, and prudent investors should thoroughly assess the associated risks before making any investment decisions.

Fundamental Analysis of Google (GOOGL) Stock Price

Displayed below is a table featuring crucial indicators sourced from Finviz.com, providing a comprehensive overview for conducting fundamental analysis of Google stock. The table includes significant metrics such as Google Stock P/E (Price-to-Earnings ratio), Google Stock Forward P/E, Google Sales, Google Dividends, and more. These essential indicators serve as valuable tools in assessing the financial health and performance of Google as a company.

| Index | NDX, S&P 500 | P/E | 27.88 |

| EPS (ttm) | 4.43 | Insider Own | 0.28% |

| Shs Outstand | 6.82B | Perf Week | 0.53% |

| Market Cap | 1572.80B | Forward P/E | 19.65 |

| EPS next Y | 6.28 | Insider Trans | -0.16% |

| Shs Float | 5.92B | Perf Month | 19.06% |

| Income | 58.59B | PEG | 1.58 |

| EPS next Q | 1.34 | Inst Own | 78.60% |

| Short Float / Ratio | 0.94% / 1.58 | Perf Quarter | 38.54% |

| Sales | 284.61B | P/S | 5.53 |

| EPS this Y | -18.80% | Inst Trans | -0.21% |

| Short Interest | 55.96M | Perf Half Y | 27.23% |

| Book/sh | 20.41 | P/B | 6.05 |

| EPS next Y | 17.77% | ROA | 16.20% |

| Target Price | 130.89 | Perf Year | 16.52% |

| Cash/sh | 9.04 | P/C | 13.66 |

| EPS next 5Y | 17.61% | ROE | 22.80% |

| 52W Range | 83.34 – 126.43 | Perf YTD | 39.95% |

| Dividend | – | P/FCF | 25.40 |

| EPS past 5Y | 23.30% | ROI | 23.40% |

| 52W High | -2.33% | Beta | 1.08 |

| Dividend % | – | Quick Ratio | 2.30 |

| Sales past 5Y | 20.60% | Gross Margin | 55.50% |

| 52W Low | 48.16% | ATR | 3.15 |

| Employees | 190711 | Current Ratio | 2.40 |

| Sales Q/Q | 2.60% | Oper. Margin | 25.40% |

| RSI (14) | 70.22 | Volatility | 2.51% 2.60% |

| Optionable | Yes | Debt/Eq | 0.05 |

| EPS Q/Q | -4.70% | Profit Margin | 20.60% |

| Rel Volume | 1.15 | Prev Close | 120.90 |

| Shortable | Yes | LT Debt/Eq | 0.05 |

| Earnings | Apr 25 AMC | Payout | 0.00% |

| Avg Volume | 35.47M | Price | 123.48 |

| Recom | 1.80 | SMA20 | 8.55% |

| SMA50 | 14.40% | SMA200 | 22.58% |

| Volume | 42,316,984 | Change | 2.13% |

GOOGL Stock Forecast: Projected Price for the Next 1 Year

In 2022, Alphabet’s stock price experienced a deviation from its previous highs, primarily influenced by global fundamental factors. Despite this, the stock has managed to remain relatively close to those levels. The pertinent question now is whether this downward movement will continue, or if the price will regain its upward momentum.

GOOGL Price: Technical Analysis Overview

To identify the most favorable entry point, it is advisable to monitor the technical analysis signals on the Google (GOOGL) chart provided by TradingView. These signals are categorized as either ‘Sell’ or ‘Strong Sell,’ indicating a bearish sentiment and suggesting a potential selling trend. On the other hand, signals labeled as ‘Buy’ or ‘Strong Buy’ imply a bullish outlook, indicating a favorable inclination to buy.

For short-term signals, it is recommended to focus on settings ranging from M15 to H2, corresponding to intervals of 15 minutes to 2 hours. These settings are suitable for assessing near-future market trends.

Conversely, when it comes to analyzing long-term signals, it is recommended to utilize settings ranging from H4 to W1, which correspond to intervals of 4 hours up to 1 week. These specific settings are more suitable for assessing extended trends and making well-informed decisions accordingly.

By incorporating these technical analysis signals from TradingView, investors can obtain valuable information about the current market sentiment and possibly pinpoint advantageous opportunities for entering the market.

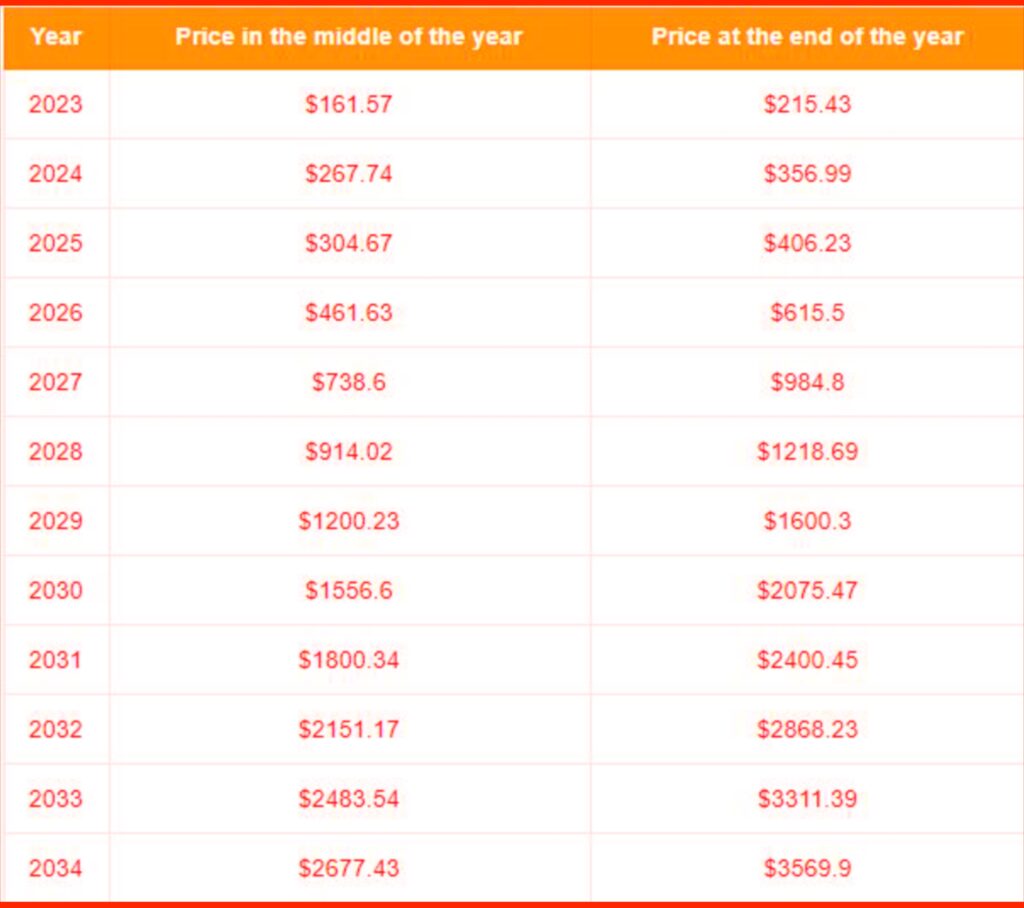

Projected GOOGL Price: 5-Year and 10-Year Forecasts by Year

Traders Union, in its comprehensive long-term price forecast for Google (GOOGL), has outlined intriguing potential price targets. According to their projections, GOOGL stock could potentially reach $407.75 by the year 2025. Looking further ahead, the forecast indicates a potential price of $2083.22 by 2030 and an ambitious $3583.24 by 2034. These forecasts offer valuable insights into the growth trajectory that Google stock may follow over the specified time periods. Nevertheless, it’s essential to bear in mind that these projections are subject to market fluctuations, and actual prices may vary from the estimated values as market conditions evolve.

Key News Events for Google (Alphabet, GOOGL) that Could Impact Future Prices

Several Crucial Factors Affecting the Price of Alphabet, Google’s Parent Company, Include:

- Global and U.S. Economic Conditions: The prevailing health of the global and U.S. economies profoundly influences the demand for Google’s products and the speculative interest in the company’s stock.

- Financial Statements and Expansion Plans: Investor sentiment is influenced by Alphabet’s financial statements and its plans for international expansion.

- Product Sales and Competitiveness: The successful sales and competitiveness of Alphabet’s new products directly impact the company’s stock price.

- Reputational Risks: As a major global technology company, Alphabet faces reputational risks from legal issues, copyright claims, and potential misuse of its market position, which can affect stock prices.

- Marketing and Development Strategies: Alphabet’s marketing, development strategies, mergers, acquisitions, and restructuring efforts can create synergies and influence future stock price growth.

When making investment decisions, investors must carefully take into account these critical factors and their potential impact on Alphabet’s stock performance.